Investing in Artificial Intelligence

Artificial Intelligence (AI) enables systems to perform tasks requiring human-like intelligence, such as learning, reasoning, and perception. Key areas include Machine Learning, where algorithms learn from data; Natural Language Processing, which allows understanding and generating human language; Computer Vision, for interpreting visual information; and Robotics, for autonomous machines.

AI is categorized into Narrow AI (specialized tasks), General AI (theoretical human-like intelligence), and Superintelligent AI (hypothetical superior intelligence). AI’s applications span healthcare, finance, and many other sectors, delivering signficantly increased efficiency for service providers and manufacturers.

In this guide to investing in Artificial Intelligence, you’ll learn about the following:

Why is Artificial Intelligence important?

Artificial Intelligence is important because it enhances efficiency and innovation across many business sectors. In healthcare, AI aids in diagnostics and medicine. In finance, it improves fraud detection and investment strategies while AI-powered automation increases productivity in manufacturing and services.

AI is driving the advancements in autonomous vehicles, natural language processing, and data analysis, leading to smarter decision-making and problem-solving. By handling complex tasks and large datasets, AI can unlock new insights and possibilities, transforming industries and improving quality of life.

While the prospect of advancement should be an exciting one for a wide-range of businesses, investors should be mindful that it’s not all good news. Ethical concerns like job displacement and privacy issues could initiate intervention from policy makers in the future.

Why should you invest in Artificial Intelligence?

Investors should, at the very least, be interested in artificial intelligence as a result of its transformative potential across a wide range of industries. With increasing data availability and computational power thanks to the quickly evolving technology behind it, AI’s growth prospects are immense, offering high returns for the savvy investor.

The role that Artificial Intelligence is playing in solving complex global challenges, from climate change to cybersecurity, makes it an important strategic investment. Investors with a long term mindset, looking for long-term gains and significant societal impact should consider exposure to AI as a result.

The wide world of AI development

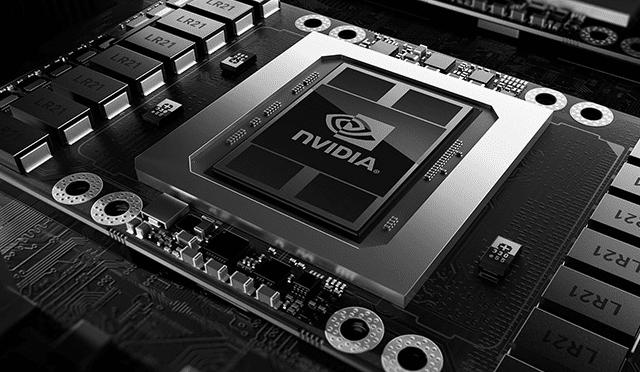

AI is already developing in new and exciting directions for investors. Companies that provide infrastructure as a service – the hardware for foundational development – are the most high profile. This list of companies includes Nvidia, AWS, Azure and the Google Cloud. Other companies like PagerDuty and Datadog are developing the essential platform infrastructure and software. It’s the fastest growing part of the sector, but one where investors get the least exposure. Beyond this, companies like Salesforce are also benefiting from AI development, as they deliver Software as a Service (Saas) applications.

Artificial intelligence and robotics

Outside pure play artificial intelligence, many adjacent sectors, like robotics, stand to benefit from this technological revolution in the very near future. As an example, iRobot, the makers of Roomba robot vacuum cleaners are looking at ways to integrate AI into their next generation of machines with the aim of helping them to distinguish between different types of rubbish in your home. For manufacturing, Industry 4.0 as it is called, holds out the potential for companies to move beyond the limits of automated manufacturing. This may be through the development of robots capable of much more sensitive processes like fruit picking or drugs manufacturing.

For investors who are already fans of the AI revolution, it can pay to investigate those companies and sectors with scope to truly benefit and profit from practical applications of the technology.

How can I invest in Artificial Intelligence?

Investors planning to invest in artificial intelligence have a range of options available to them. Exchange Traded Funds that focus specifically on the AI sector are a great place to start. For those who are more risk tolerant, the appeal of identifying a unicorn or ten-bagger will throw up any number of young tech stocks that could be the next big thing, or for those who prefer to follow the crowd, the Magnificent 7 could be the place to start. But beyond this there are a broad range of other companies within the sector and adjacent sectors which have the potential to be highly profitable in the years to come. We take a look at your options below.

Diversifying outside the Mag 7 stocks

Investors can diversify their AI exposure to include companies at the very forefront of innovation which are less well known but positioned for significant growth. Examples include the likes of Palantir, CrowdStrike and Datadog, which all build customised AI applications in the fastest growth segment of the AI software market.

Furthermore, investors looking to gain a more complete exposure to the AI growth story can venture beyond solely focusing on AI software to include Robotics. The convergence of AI and robotics is driving significant productivity gains in the physical world particularly through the development of adaptive robotics and autonomous mobility. Disruptive companies such as Teradyne, Tesla and Rocket Lab are leading the charge here, among many others.

By broadening your exposure outside the Mag 7 stocks, you also avoid some of the concentrating risk which is inherent

Investing in AI with Exchange Traded Funds

Adding an Artificial Intelligence themed Exchange Traded Fund to your portfolio can provide you with the artificial intelligence exposure you are looking for without the risk of buying just one AI related stock (see below). An AI themed ETF will consist of a number of AI related stocks, chosen by the manager in accordance with the ETF’s objectives. This may be a focus on smaller companies, or larger, more established businesses. Make sure you research the objectives of each AI ETF before you purchase to ensure the exposure you will gain meets with your investment goals.

Here are some Artificial Intelligence ETFs for you to consider. These ETFs can be purchased via most established online platforms. We have a selection of investment platforms to help you get started – listed below.

Artificial Intelligence UCITS ETF

Ticker: LON:INTL

Currency: USD

Artificial Intelligence stocks

Investors can gain exposure to the artificial intelligence megatrend by investing in listed companies that are focused on AI development. The leading contenders are big US tech firms like Alphabet (Google) NASDAQ:GOOGL, Microsoft NASDAQ:MSFT, Amazon NASDAQ:AMZN, and NVIDIA NASDAQ:NVDA. Opportunities for significant growth are likely to be reduced as these stocks are already large established businesses – however, they continue to surpass expectations so cannot be ruled out.

Smaller business that are positioned within the sector can offer more significant rewards, but they also come with far more risk. Take a look at our reports on a range of artificial intelligence stocks, designed to provide you with some great ideas for your portfolio.

Expanding your search

Artificial Intelligence is a foundational technology that will accelerate growth in a wide range of sectors, fueling megatrends, like robotics, cloud software, cyber-security, finance, healthcare, energy transition, autonomous vehicles and recycling. These sectors, and many others, are set to benefit from the advancement of artificial intelligence and investors can broaden their search by focusing on these sectors where AI is likely to support significant change, in order to gain exposure within their portfolio.

Share this Guide

Advertisement

Don’t miss out on our weekly newsletter for great tips, ideas and news on the financial markets